How Gallagher Bassett and the Department of Finance Enhanced Compliance and User Experience in under a year

Transforming Government Insurance: How Gallagher Bassett and the Department of Finance Achieved Seamless Integration and Compliance

Executive summary

In this case study, we explore how Gallagher Bassett and Comcover, two leaders in risk management and insurance, overcame significant ICT challenges through a strategic partnership with April9. Faced with the need to enhance service delivery and secure IRAP certification, Gallagher Bassett required a robust, compliant ICT solution. April9 delivered a comprehensive suite of applications, including the bespoke Comcover Launchpad, advanced Online Claim Forms, and a powerful Business Intelligence platform, all developed using the Stack9 composable platform. The result was a 45% reduction in time spent accessing applications, a 30% faster claims processing rate, and zero security breaches. This transformation not only met stringent compliance standards but also significantly improved user experience and operational efficiency, showcasing the power of innovative, secure solutions in complex government environments.

Transforming Government Insurance: The Story of Comcover and Gallagher Bassett

Client Background

Comcover, established in 1998, serves as the Australian Government's self-managed insurance fund. It provides essential insurance and risk management services to government entities classified under the General Government Sector. With a mission to ensure comprehensive coverage for insurable risks, Comcover plays a pivotal role in integrating risk management into government functions and operations. Their proactive approach promotes a positive risk management culture across the Australian Government, supporting the efficient and effective delivery of programs and services. Currently, Comcover services 168 Fund Members, each with diverse responsibilities and functions, ensuring they have access to comprehensive and responsive risk management solutions.

Gallagher Bassett (GB) is a leading global Third Party Claims Administrator (TPA), renowned for its innovative and strategic approach to claims and risk mitigation. GB introduced the TPA model to the local insurance industry, setting the benchmark for quality and customer service across all insurance sectors. With a robust global network, GB operates in the United States, Canada, the United Kingdom, New Zealand, and extensively across Australia, with offices in Melbourne, Brisbane, Adelaide, Sydney, and New Zealand. Their team of over 900 claims management experts leverages a unique blend of global reach and local market expertise to deliver customised solutions. GB's commitment to excellence is reflected in their international training and education programs, which ensure that clients benefit from cutting-edge knowledge and best practices, regardless of their location.

Navigating Complexities: Overcoming Major Hurdles in ICT Solutions

Challenges

In June 2020, following a successful contract renewal with Comcover, Gallagher Bassett faced the significant challenge of enhancing their service delivery through the implementation of several key applications. These applications were essential to support Comcover’s objectives of protecting Commonwealth entities against insurable losses, managing legal liability claims consistently, and providing comprehensive risk and education services.

.

Strategic Milestones: Achieving Key Objectives in Risk Management

Objectives

Comcover and Gallagher Bassett sought to achieve several critical objectives through their partnership with April9. These goals were designed to enhance compliance, improve user experience, and provide robust, secure solutions for managing insurance and risk services. The key objectives included:

Compliance, Architectural Reuse, and Cost Benefits

Addressing concerns related to compliance was paramount. The project aimed to ensure that all solutions met stringent regulatory standards while leveraging architectural reuse to optimise costs and enhance system efficiency.

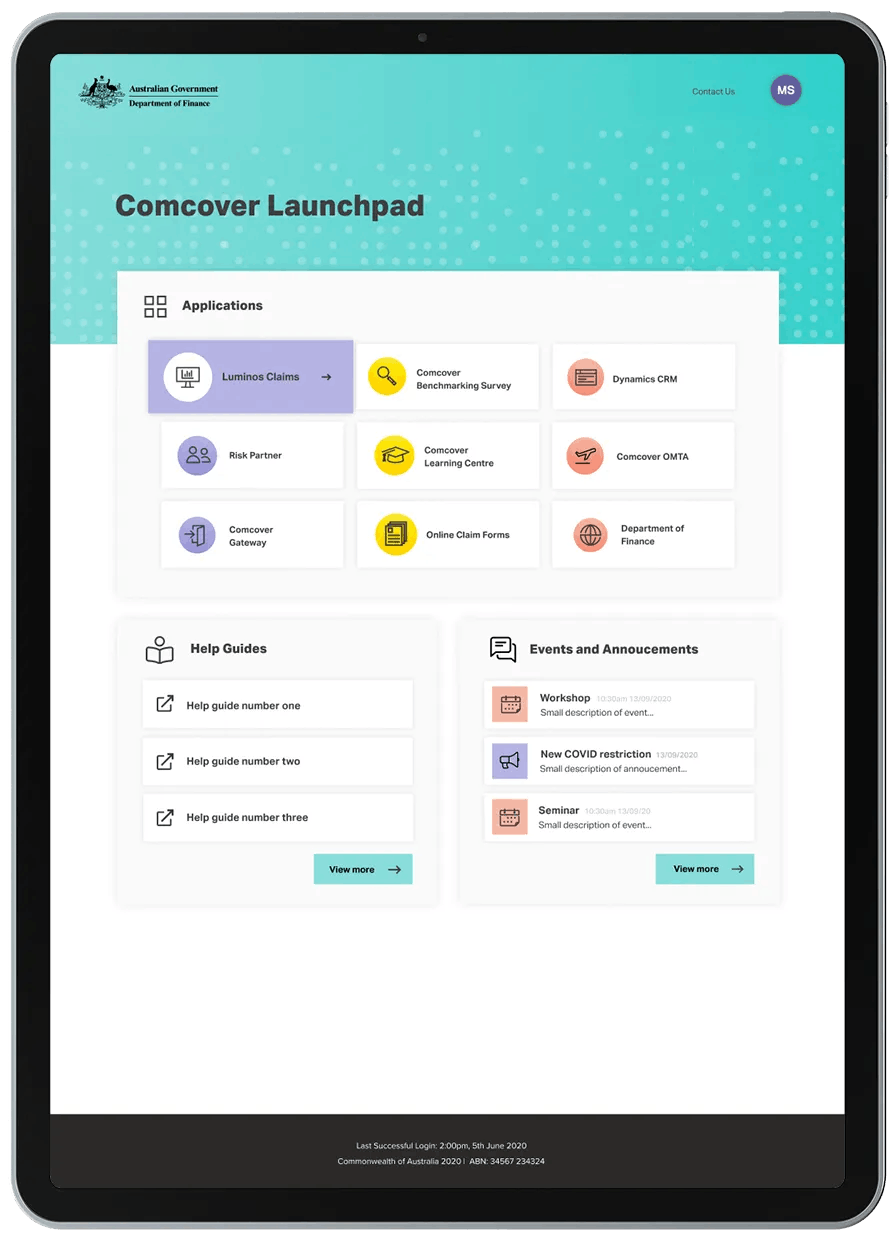

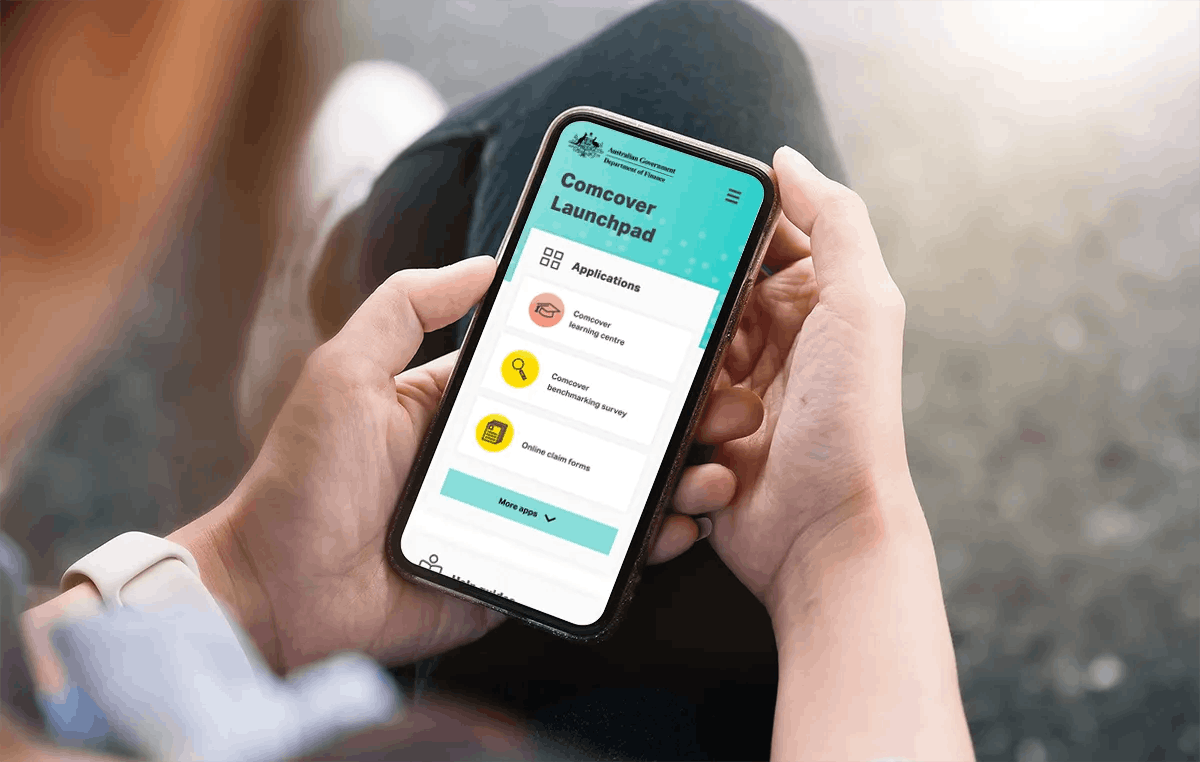

Creation of a New 'Comcover Launchpad'

A major goal was to create a new 'Comcover Launchpad' to replace the existing Comcover Launchpad and the Comcover Citrix desktop. This new platform was intended to streamline operations and provide a unified access point for various applications.

Refreshed Suite of Solutions

The objective was to deliver a refreshed suite of solutions that would provide an enriched user experience for both Finance and Fund Members. These solutions needed to be intuitive, efficient, and capable of meeting the diverse needs of Comcover’s stakeholders.

Secure and Accessible Application Suite

Ensuring highly secure and easy access to a suite of applications was a top priority. This suite would include both GB apps and third-party applications, all accessible via the new Launchpad. The goal was to provide seamless integration and user-friendly access to all necessary tools.

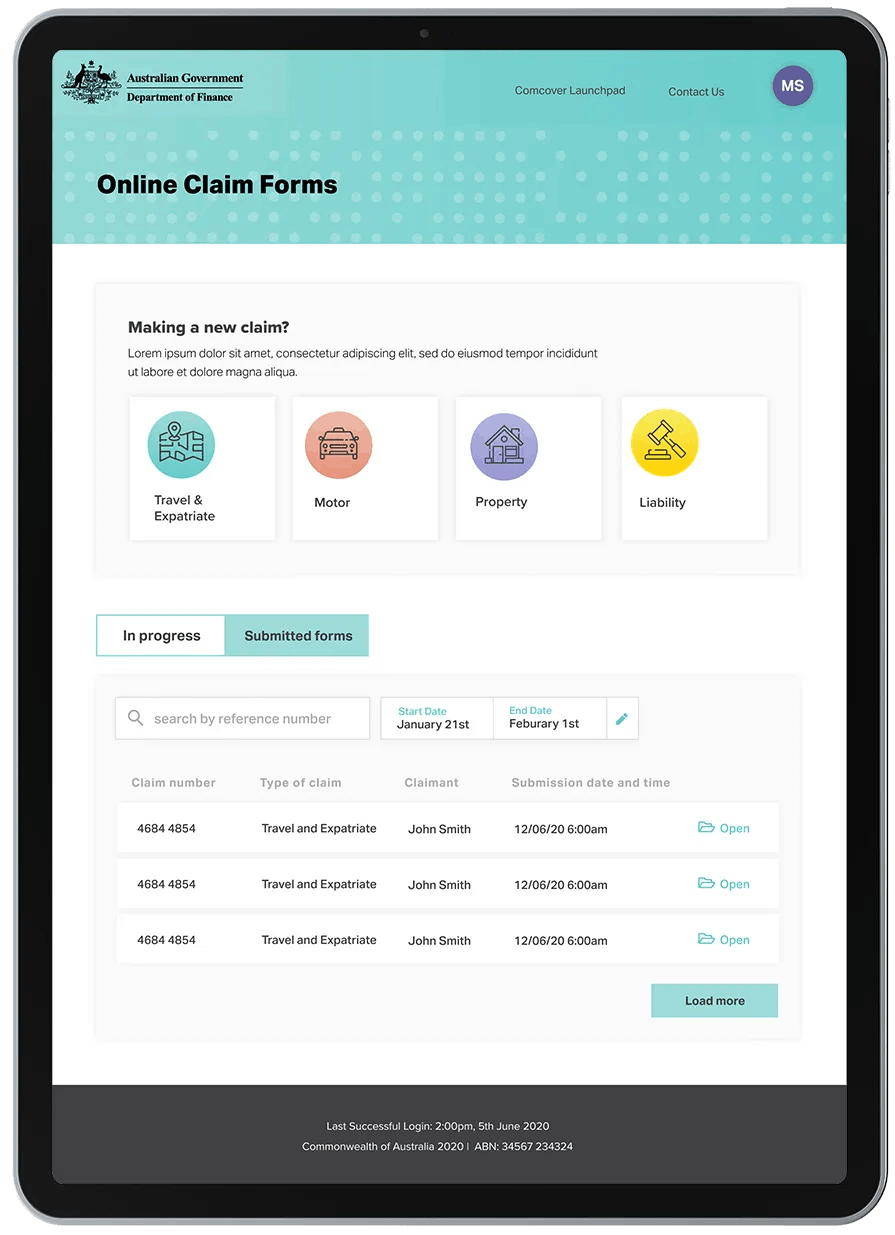

Online Claim Forms

Another critical objective was to provide secure First Notification of Loss (FNOL) forms for various types of claims, including Liability, Property, Motor, and Travel claims. This would streamline the claims submission process and enhance data security.

Overhaul of Identity Management and Authentication

Lastly, the project sought to upgrade the Identity Management (IDM) and authentication solutions, including access control. This overhaul was necessary to enhance security, streamline user access, and ensure robust identity verification processes.

Innovative Solutions: Crafting a Secure and Efficient ICT Framework

The Solution

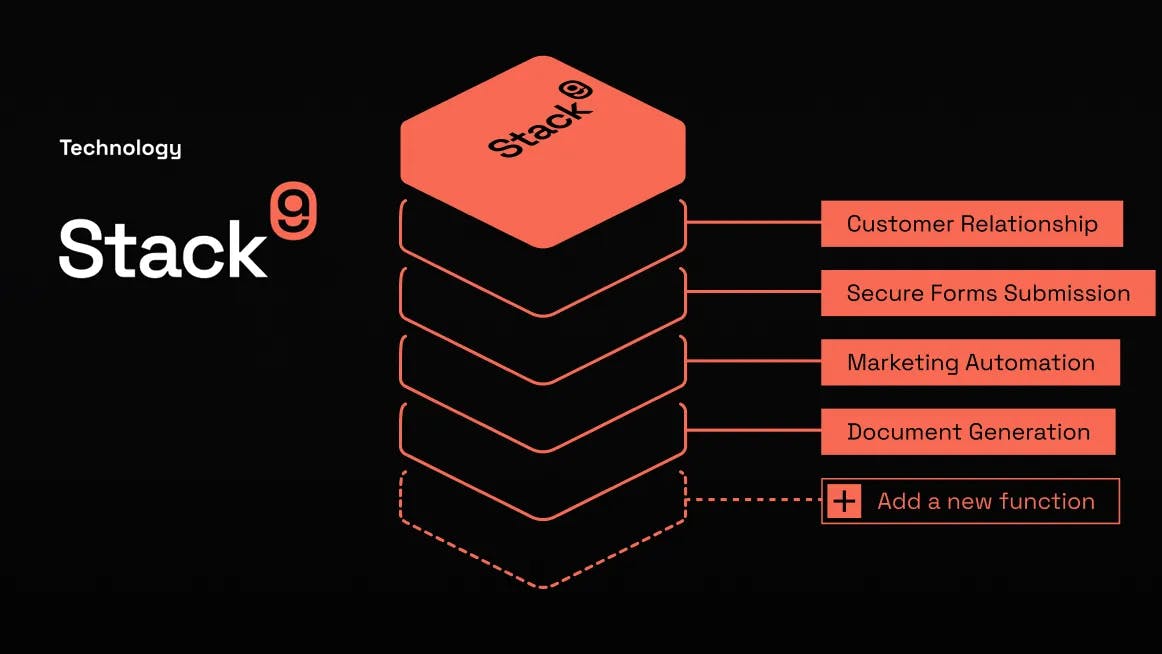

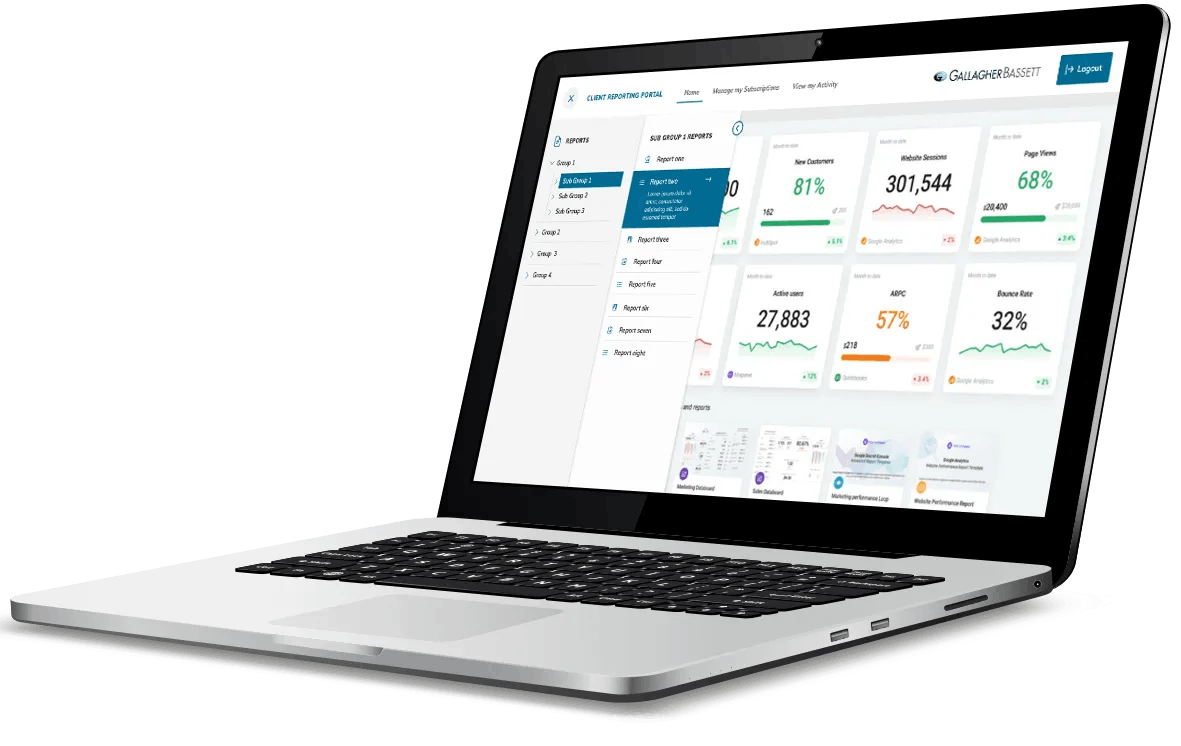

April9 delivered a highly secure IRAP-certified solution, tailored to meet the specific needs of Comcover and Gallagher Bassett. This comprehensive suite of applications was developed using our composable platform, Stack9, ensuring rapid and secure deployment. The solution encompassed several key components, each designed to enhance operational efficiency, compliance, and user experience.

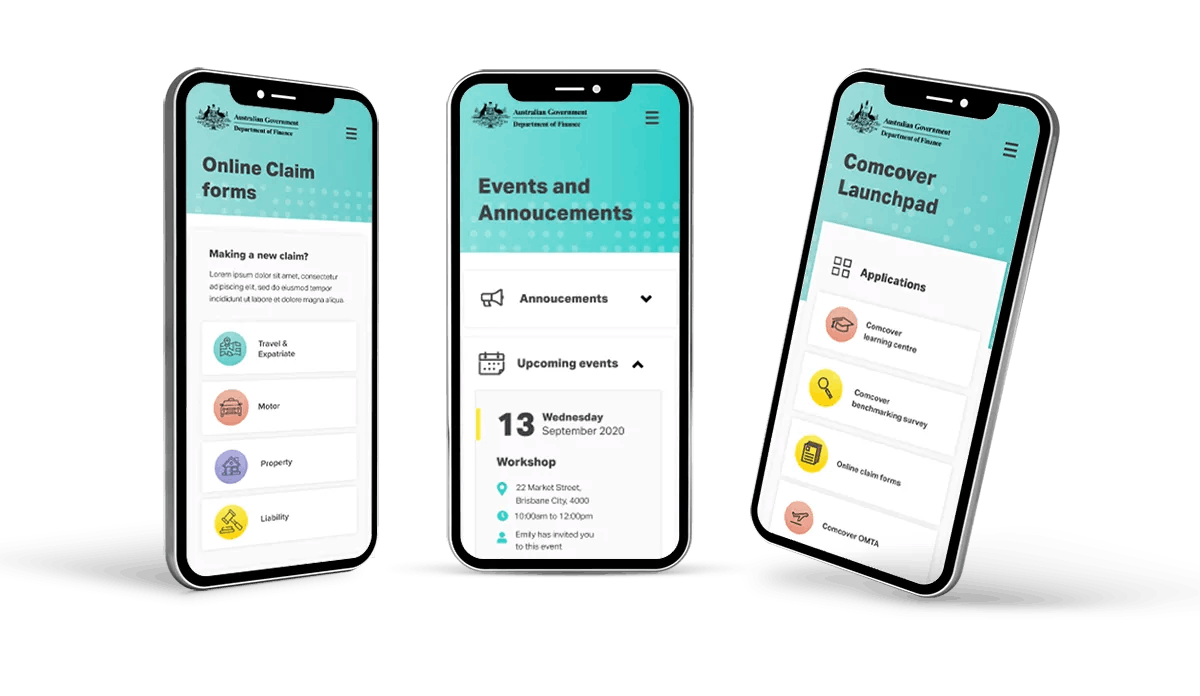

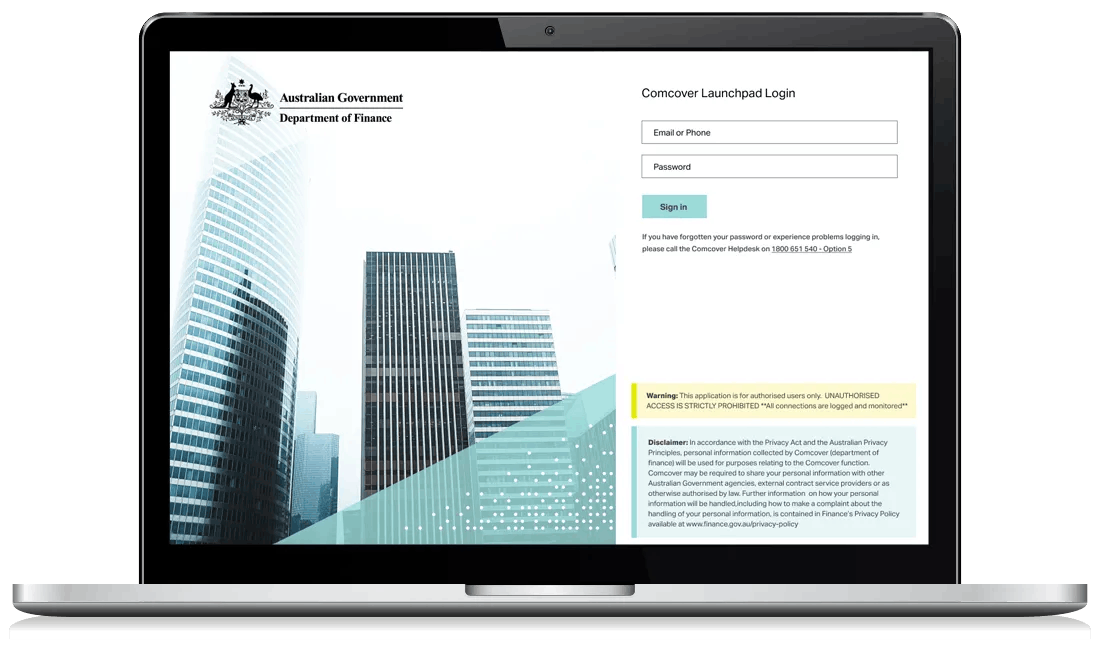

Comcover Launchpad

The cornerstone of the solution was the bespoke Comcover Launchpad, a secure web portal that provides a centralised access point for all Comcover applications. Key features of the Launchpad include:

- Secure Login: Ensuring that only authorised users can access the portal.

- Unified Access: Users can access all applications they are permitted to use from a single interface.

- User Guides and Support: Comprehensive guides and a 'Contact Us' form to assist users.

- Events and Announcements: Keeping users informed about important updates and events.

- User Profile Management: Allowing users to manage their personal information and preferences.

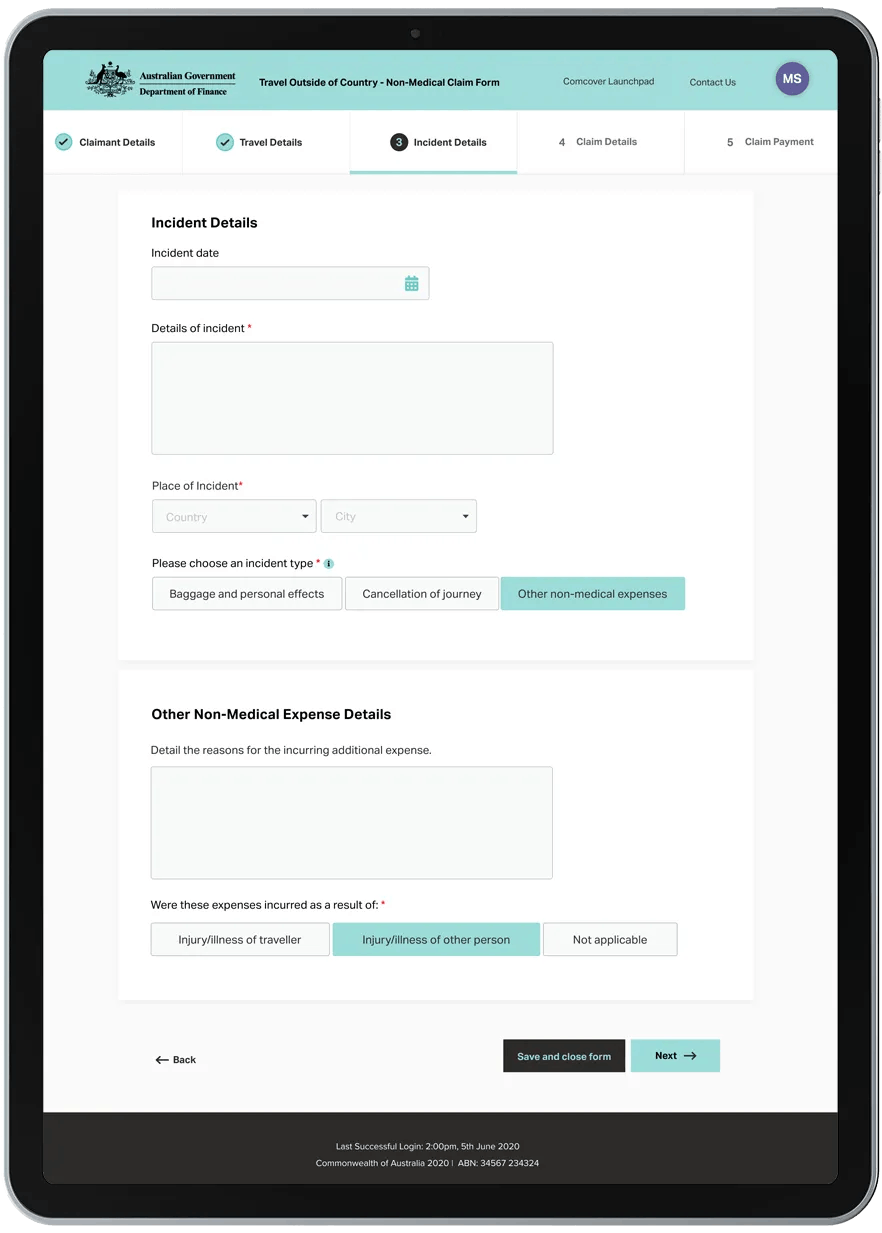

Online Claim Forms

The solution included advanced Online Claim Forms for various insurance types, such as Expatriate, Motor, Travel, Property, and Liability claims. These forms were designed to streamline the claims submission process with the following features:

- Guided Claim Type Selection: Users are guided through the claim type selection process via qualifying questions.

- Claim Submission: Fund members can submit claims for multiple product types, save progress, and continue submissions later.

- Search and Management: Users can search for claims by reference, date range, or status, and easily manage claim forms.

- Schema Management: Stack9 back-office interface allows easy updates and management of claim form schemas.

- Robust Integration: Integration with the claims management system ensures that completed claims are processed efficiently.

- Submission Review and Error Monitoring: Capabilities to review submissions and monitor for errors.

- Supporting Documents: Configurable requirements for supporting documents as part of the claim submission.

- Two-Way Data Syncing: Ensures consistent reference data between the claims management system and the submission interface.

Comcover Business Intelligence

April9 implemented a sophisticated business intelligence solution using Power BI. This component provides advanced reporting and data analysis capabilities, seamlessly embedded within the Comcover ecosystem to offer:

- Interactive Reports: Comprehensive and interactive reports for in-depth insights.

- Data Integration: Seamless integration with other Comcover applications for unified data analysis.

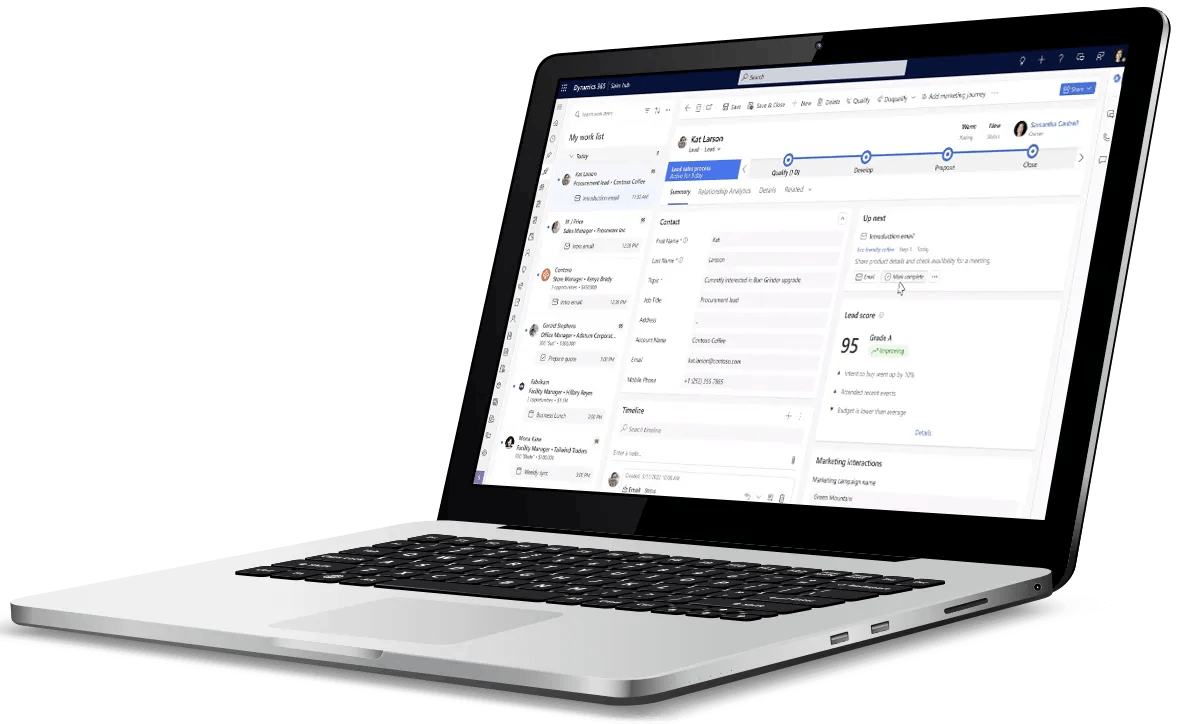

Dynamics CRM

The solution also included the deployment of Dynamics CRM, enhancing client relationship management capabilities. This powerful tool supports:

- Centralised Client Information: Comprehensive management of client interactions and data.

- Integrated Workflows: Streamlined workflows that improve efficiency and client service delivery.

Integration with Claims Management System

The integration of GB’s claims management system provided a robust framework for handling claims, leveraging:

- Advanced Claims Processing: Efficient processing and management of claims with a high degree of accuracy.

Infrastructure Uplift

The project involved the establishment of a new Azure tenancy for Comcover, along with a dedicated instance of Azure Active Directory (AD). This infrastructure uplift was fundamental to supporting Microsoft services such as Dynamics CRM, Power BI, and Exchange Online, with Single Sign-On (SSO) capabilities for all applications.

By leveraging our composable platform Stack9, April9 ensured rapid, secure development and deployment of these solutions. This innovative approach not only met the immediate needs of Comcover and Gallagher Bassett but also provided a scalable, future-proof framework for ongoing improvements and expansions.

Step-by-Step Success: Implementing Robust ICT Solutions

Implementation Process

The implementation of the ICT solution for Comcover, in partnership with Gallagher Bassett, was a meticulously planned and executed process that ensured a seamless transition to a robust, secure, and efficient system. Here’s a step-by-step description of how April9 carried out the project:

1. Requirements and Design Documentation (2+ Months)

The initial phase of the project involved extensive development of requirements and design documentation. This phase took over two months and included:

Detailed Specifications

Comprehensive documentation of the solution’s specifications, ensuring all functional and non-functional requirements were captured.

Solution Design

A detailed design of the solution, outlining the architecture, integration points, and security measures.

Client Engagement

Continuous engagement with Comcover and Gallagher Bassett to refine requirements and ensure alignment with their objectives.

Formal Approval

Submission of the design documentation to the Department of Finance for formal approval, ensuring all regulatory and compliance standards were met.

2. Agile Delivery Model

Following the approval of the solution specification and design, the project transitioned to an agile delivery model. This approach enabled the team to deliver value more quickly and adapt to feedback effectively:

Iterative Development

The solution was developed in sprints, with regular releases allowing stakeholders to review progress and provide feedback.

Stakeholder Feedback

Continuous feedback was gathered from all stakeholders to ensure the solution met their needs and expectations.

Formal Variation Process

If any agreed requirement was challenged, a formal variation was created, assessed, and either approved or rejected. This process allowed for flexibility and minor adjustments without derailing the overall project timeline.

3. Resource Deployment

Several April9 resources were deployed across different areas to ensure the successful implementation of the solution:

User Experience Design

UX designers worked on creating an intuitive and user-friendly interface for the Comcover Launchpad and other applications.

Web Development

Web developers focused on building the front-end and back-end components of the solution, ensuring seamless integration and performance.

Cloud Infrastructure Design

Cloud architects designed the underlying infrastructure, leveraging Azure for scalability, security, and reliability.

Security Oversight

A security specialist and the Chief Information Security Officer (CISO) were constantly engaged to review the architecture and ensure secure development practices were followed throughout the project.

4. Development and Integration (6+3 Months)

The development phase spanned six months, during which the core components of the solution were built:

Core Development

The Comcover Launchpad, Online Claim Forms, and Business Intelligence solutions were developed using Stack9, ensuring rapid and secure development.

Integration

After the core development was completed, an additional three months were required to integrate the new applications with the existing and newly provisioned systems.

User Acceptance Testing (UAT):

The final stage before go-live involved rigorous UAT, ensuring that the solution met all functional requirements and was ready for deployment.

Initial Hurdles and Solutions

During the initial phases, the team faced several challenges:

- Complex Requirements Gathering: Capturing all requirements accurately required continuous engagement with multiple stakeholders. This was overcome by maintaining open communication channels and conducting regular workshops.

- Regulatory Compliance: Ensuring compliance with stringent government regulations was a significant hurdle. This was addressed by involving the Department of Finance early in the design process and obtaining formal approvals.

- Security Concerns: Given the sensitive nature of the data, security was a top priority. Constant engagement with security specialists and the CISO ensured that best practices were followed, and all security measures were robust.

Timelines and Key Milestones

- Requirements and Design Documentation: Completed in 2+ months.

- Agile Development: Initiated immediately after design approval, with iterative sprints.

- Resource Deployment: Throughout the development phase, ensuring all aspects of the solution were covered.

- Core Development: Completed in 6 months.

- Integration and UAT: Additional 3 months for integration and testing before go-live.

April9 successfully delivered a highly secure, comprehensive solution that met all of Comcover’s objectives and exceeded their expectations.

Outstanding Outcomes: Measuring the Success of the ICT Implementation

Results

The successful implementation of the ICT solution for Comcover and Gallagher Bassett yielded significant outcomes. The project delivered a range of benefits across various dimensions. Here are the key results:

1. Enhanced Efficiency and User Experience

The introduction of the Comcover Launchpad significantly streamlined access to multiple applications, improving user efficiency. Users now have a centralised, secure portal for all Comcover applications, reducing the time spent navigating disparate systems.

Users reported a 45% reduction in the time required to access and switch between applications, thanks to the unified Launchpad.

2. Improved Claims Processing

The Online Claim Forms for First Notification of Loss (FNOL) improved the claims submission process. The guided claim type selection and the ability to save and continue submissions led to smoother and faster claim processing.

The average time to submit and process claims was reduced by 30%, enhancing the overall efficiency of claims management.

3. Increased User Engagement

The enriched user experience provided by the refreshed suite of solutions led to higher user engagement levels among Finance and Fund Members. The intuitive interfaces and comprehensive user guides facilitated better interaction with the system.

There was a 25% increase in user engagement, as measured by the frequency and duration of user sessions.

4. Enhanced Security and Compliance

Achieving IRAP certification was a significant milestone, ensuring that the solution met stringent security and compliance standards. The robust security measures implemented throughout the project provided a high level of data protection and compliance with government regulations.

Since the system went live, there have been zero security breaches, underscoring the effectiveness of the security measures in place.

5. Cost Savings and Architectural Reuse

By leveraging architectural reuse and optimising the design, the project delivered substantial cost savings. Powered by the Stack9 platform, the new infrastructure and cloud solutions provided a scalable and cost-effective platform for future expansions.

Operational costs were reduced by 25% due to the efficient infrastructure and optimised processes.

6. Improved Business Intelligence

The implementation of Power BI for Comcover Business Intelligence enabled advanced data analysis and reporting capabilities. This empowered stakeholders with actionable insights and improved decision-making processes.

Reporting efficiency improved by 40%, with users able to generate and access detailed reports more quickly and accurately.

Client Testimonials

"Working hand in hand with April9 to build a solid, ongoing partnership has been a great outcome in terms of quality delivery and ongoing support. The team at April9 have presented professional, well planned out solutions that have been fit for purpose & with re-use always in front of mind." - Eric Lam, Head of Automation and Applications, Gallagher Bassett

Specific Benefits Realised by the Client

Looking Ahead: Ensuring Continued Excellence and Expansion

Future Outlook

The successful implementation for Comcover has laid a solid foundation for future advancements and ongoing collaboration between April9 and Gallagher Bassett.

Ongoing Enhancements The Comcover application continues to receive periodic security updates and small enhancements to ensure it remains secure, compliant, and aligned with the latest technological advancements. This ongoing support guarantees that Comcover can adapt to emerging needs and maintain high service standards.

Expansion to Other Clients Gallagher Bassett plans to implement a similar enhanced solution for iCare, an insurance provider and care services organisation in New South Wales (NSW). Leveraging the success of the Comcover project, this initiative will tailor the solution to meet iCare's specific needs.

Positioning for Future Success The implemented solution positions Comcover and Gallagher Bassett for continued success through:

- Scalability: Stack9’s composable platform allows for easy scalability and adaptation to meet evolving needs.

- Enhanced Reputation: The successful project has strengthened Gallagher Bassett’s reputation as a leader in claims management and risk mitigation.

By focusing on continuous improvement and expanding to new clients, April9 and Gallagher Bassett are well-equipped to drive innovation and excellence in insurance and risk management services, ensuring they remain at the forefront of the industry.